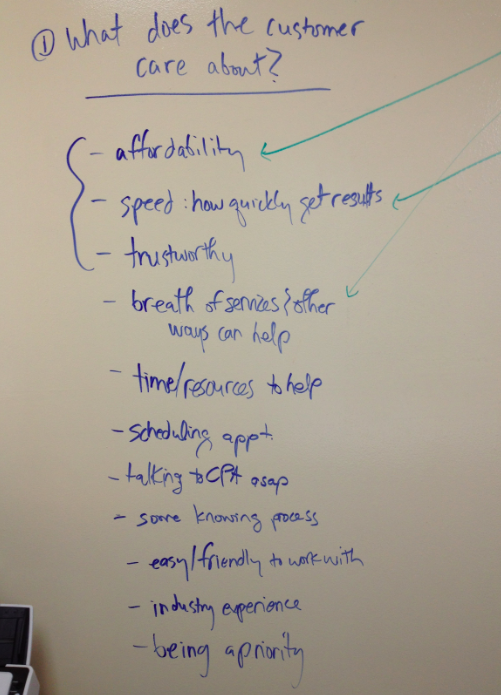

This past year our team undertook the effort to re-design our customer on-boarding process. We met and started brainstorming over some basic questions: What does the customer care about? What should they care about? Any and all items were noted up on our whiteboard wall.

Over a series of get-togethers, we proceeded to follow more questions down a road to define customer touchpoints, process steps, components we needed to build out, and ideas on how to build them out. Since that time, we’ve completed some basic “construction,” and we continue to build out more components as we go along. But the biggest revelation to me from the whole process was to define the results we wanted to achieve. And that the definition was a narrative, not a number.

What do I mean? For example, some of the process results we defined were: