I’ve suggested before that accounting is not the language of business, but that I do think CPAs bring unique abilities to the conversation of business. In a world of information, perspective is king, and if we can see our finances in their broader context, I think we go a long way to growing stronger.

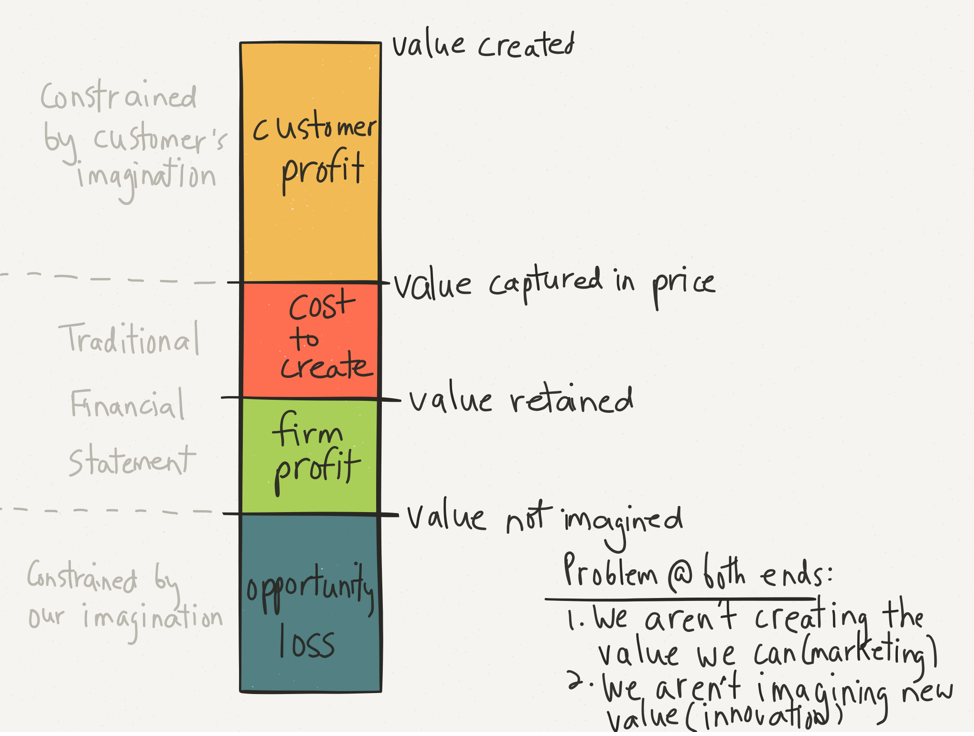

To that end, I’d like to propose that your (and any other business’) two most important numbers don’t appear on your income statement: (1) customer profit, and (2) opportunity loss. This graphic helps illustrate:

Some of you may recognize part of this graphic from value pricing theory — it posits that we create value for our customers, and we capture only a portion of that value through our price. That’s how it’s supposed to be: a customer wouldn’t enter into a transaction if they receive less value than they actually pay for, so we must create for them a “customer profit.”

And as entrepreneurs, we’re constantly looking for ways to arrange our resources such that they create greater value than they consume — we want the “cost to create” to be less than the “value captured in price.” This leaves a “firm profit” which can be reinvested to create more value inside the entity or redirected to create more value outside the entity.

However, our largest cost, and the one we often fail to consider, is opportunity cost. Once we include opportunity cost, we may actually be running a loss — something I’ll call, “opportunity loss.” Opportunity loss arises to the degree the resources we have are not being put to their best use.

So let’s dig a little bit deeper into customer profit and opportunity loss.

“Value captured in price” (what gets called “revenue” on most income statements) is actually just a shadow of “customer profit.” If a business is failing to meet the needs of its market, customer profit begins to shrink. It’s completely invisible to traditional accounting, but absolutely critical to the health of the business. There becomes more and more of a challenge to justify price, until customer profit starts pressing down against price, and finally revenues start to drop. Suddenly it becomes an issue to traditional accounting, at which point it may be too late. I suggest that if a business doesn’t have a way to understand and manage its customer profit, it’s putting itself in a risky position and playing a dangerous game. There are plenty of examples of failed companies, large and small, who have found themselves in this position.

Opportunity loss. We can find ourselves so tied up in the present and past that we don’t have time to give thought to the future. Some resources we have need to be let go because they’re consuming our attention, which would be better applied elsewhere. This may be knowledge that’s run its course, product lines that no longer fit, physical assets that don’t mean as much as they use to, etc. Opportunity loss comes from “value not imagined” — value that we have the potential to create, but because our resources are otherwise committed right now, we can’t see or can’t initiate. As entrepreneurs, we’re often making that judgement call: is how we’re applying our attention the best use of our entity’s resources? For any business, that opportunity loss grows over time too — when everything’s first setup, we probably have a pretty low opportunity loss since all is freshly arranged. But the longer things move around and within us, and we don’t, the size of the opportunity loss grows. ‘Til one day our resources have become such a claim on us, it’s become very hard to change. Opportunity loss also shows up nowhere on our financial statement, and if we don’t have a way to identify and respond to it, I also think we’re putting our business at risk.

What is the way out? Imagination. By exercising imagination, both “customer profit” and “opportunity loss” are answered. Imagination begins with the business: imagining how it can better put resources to use to create a better customer profit. And the imagination of the business then flows to the customer: helping them catch the vision of the new customer profit that is possible for them. In some ways, the economy is really a cooperation of imaginations and values. The double-edged corollary, though, is that its biggest constraints are our imaginations and our customers’.

After working through all this, I was reminded of a quote my friend Ron Baker shared with me from Peter Drucker: “Business has only two functions — marketing and innovation.” After considering the above, I’d suggest marketing is about customer imagination, and innovation about our own. And that “customer profit” and “opportunity loss,” for both ourselves and our customers, are two of the most important figures we can be keeping our professional eye trained upon.

(As originally posted on the Thriveal blog.)